Why Real Estate is a great investment option during this phase

Mumbai- December 17, 2020

The real estate sector took a huge hit following the onset of COVID19 and lockdowns. Real estate dealers suffered losses due to halted constructions, reverse migration of labourers, and the fall in demand in the housing sector for several months. The value of several properties has gone down, as dealers have been forced to reduce the value in order to make sales happen in such times.

Though safety measures have been successfully enforced and being followed by all businesses including the real estate, making it plausible for the sales to be continued safely since the past 2-3 months, it is undeniable that economy has slowed down.

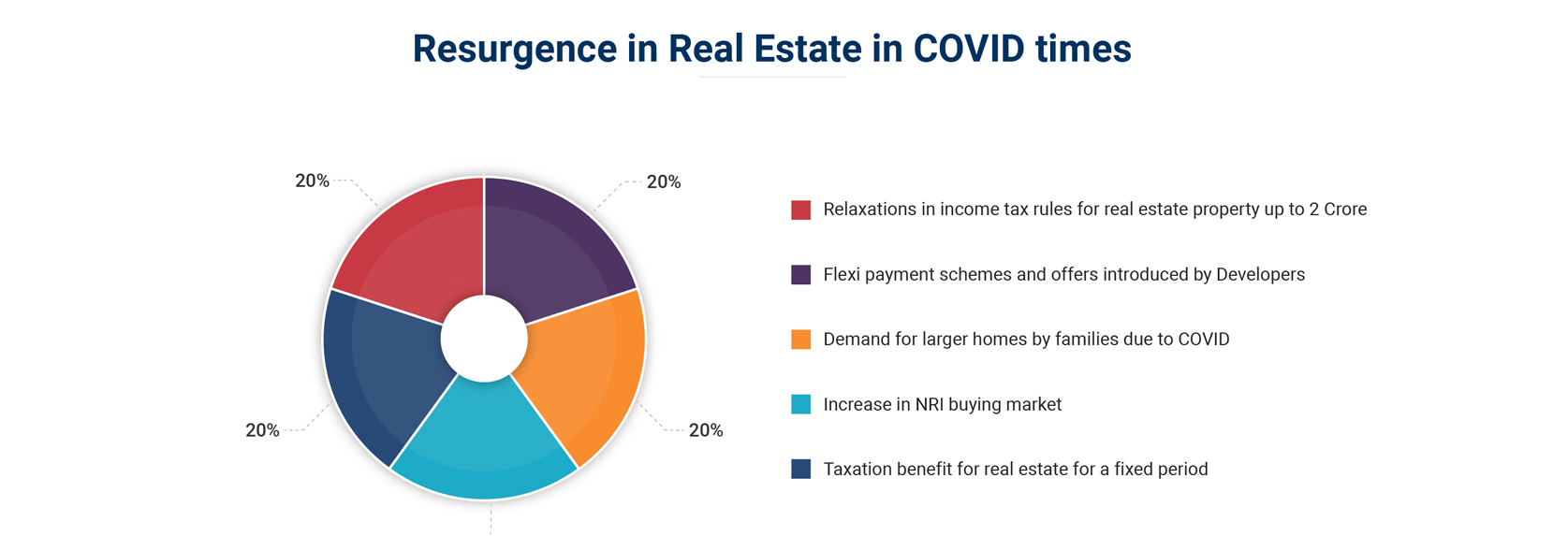

To boost the demand for real estate property and to revive the business, the finance minister Nirmala Sitharaman and Indian government have announced relaxations on the income tax rules, in order to allow the sale of residential property units up to Rs.2 Crore. This relaxation will help clear unsold inventory of residential units valued at up to Rs 2 crore. Buyers can now purchase real-estate property – houses or apartments, at 20% below the circle rate – that is, the government-defined value at which property is registered, without attracting any tax penalties

Whereas, the price that is finally agreed upon after negotiations between the builder and the buyer is known as agreement value. Until now, only 10% differential between the circle rate and the agreement value was allowed. To boost the real estate sector, the differential was increased to 20% for a fixed period of time (up to around June 2021)

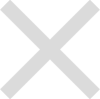

According to a survey conducted, many 1-tier cities (Delhi, Mumbai, Kolkata, Hyderabad, Bengaluru, Ahmedabad, Pune, Chennai) have been able to recover from the hit they have experienced due to COVID due to the relaxations on taxes and other measures taken to encourage more people to buy real estate property in the COVID times. (refer to the bar graph below for a more detailed report).

Also as a result of the pandemic, home buyers are now looking for homes with space to work, attend classes, exercise, etc. – all from the confines of one home. And the area of such a home definitely needs to be larger to accommodate these, for all members living in the house.

Builders thus have been getting more and more requests for larger homes, because people now want more space – now that most people in every family have been working from home

Another factor is the exodus of NRI crowd to India – with many NRIs (especially from the middle east and Europe) looking to buy homes in India. The main reason for this is the low value of the rupee, and several Indians’ unsuccessful stints abroad as a result of job losses due to the virus, leading many of them to gradually shift back to India. It was predicted that NRI buying market will throng the real estate sector due to prices bottoming out in the last few months; and NRI buyers will have contributed to about 15-20% of the annual demand in real sector.

The following are effects and consequences of the aforementioned factors:

- Residential real estate is essentially driven by demand in the market, and demand depends on what (potential) home buyers are looking for in a property. In the current situation – security is one thing many people are wanting to ensure, when deciding to invest in a property. Category A properties are properties which have a premium advantage over the average rent prevailing in the area where they are located because they a usually newly built and have all the requisite infrastructure. due to this credibility that they provide, there has been a high demand for these, and hence an increase in sales of property by Category A developers.

- Investing in a capital asset which promises future returns has now become a bigger priority than pre-COVID times, for people with disposable incomes. Due to this, RTMI homes are witnessing increased demand – (also as these are ready to occupy, which is the need of the hour for many) and are becoming the most preferred choice, especially for first-time home buyers.

- Since October 2020, the number of residential units registered have gone up significantly, as slowly beginning to realize this need more than ever now. The period between October to December 2020 has reportedly seen a record number of registrations – the highest since the onset of the COVID 19.

All these have led to the gradual revival of real estate sector in India, in the era of the corona virus. Though currently none of us are in a state to predict when normalcy will kick in, a perpetuation of this run is expected, as the government also plans to introduce more measures to support the real estate sector; and with more developments in technological advancements like e-commerce, video tours of houses and advanced payment methods and online transactions getting popular, this industry is predicted to keep attracting investors in the foreseeable future.